A Quick Guide To Paying Down Debt Over Time

Having debt can be overwhelming and stressful. Credit card debt starts to build up it can seem like a never-ending burden, but there is hope at the end of the tunnel. All it takes is a plan, a little bit of sacrifice and dedication to eliminate the debt. Here is an extremely simple plan to follow that will allow you to pay down debt.

DETERMINING HOW MUCH DEBT

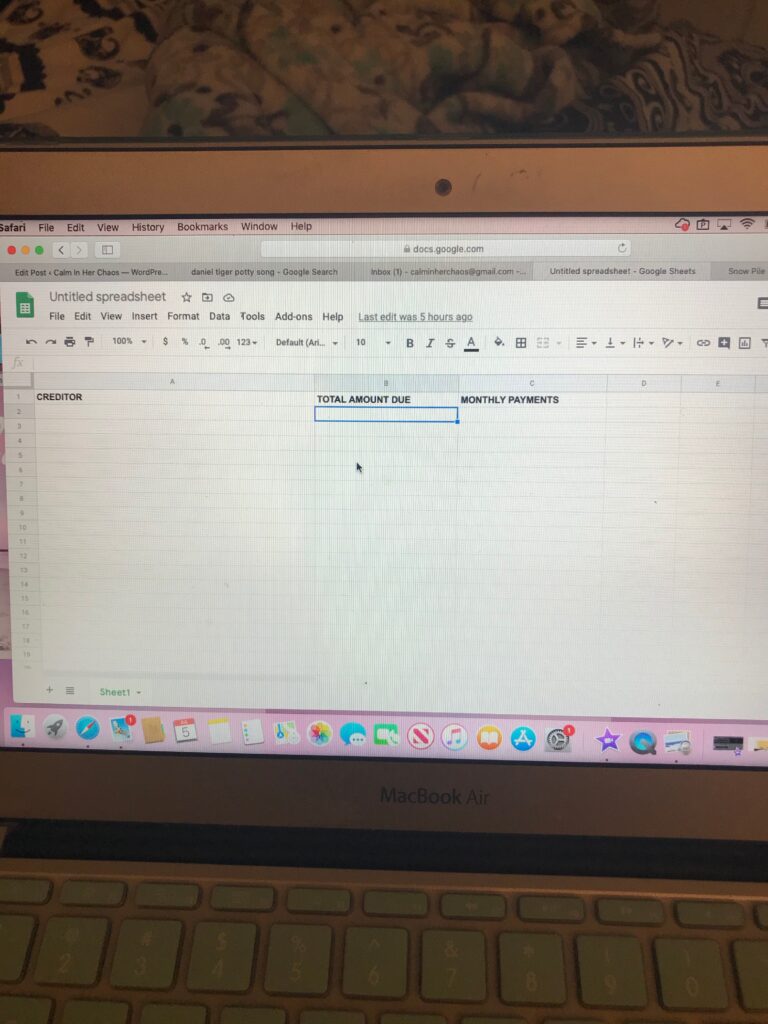

The first step is to sit down and figure out exactly how much debt you have. A good place to start is by making a simple list of all your monthly payments. This will also help you determine your total monthly expenses as well. Your list should include: company/creditor name, monthly payment amount, and total amount owed.

After you figure out how much you owe in total to each creditor, arrange these debts in order from the largest balanced owed to smallest balanced owed. Make sure the list is arranged by the total amount owed and not by the monthly payment amount. This list will give you a good starting point for this method of paying down your debts.

CHECK YOUR CREDIT SCORE

Checking your credit score is an important part of paying down your debts. As you pay down your debts your credit score will begin to rise. Obtaining a copy of your credit report will help determine if there is any additional debts on your report that you are not aware of.

There are many ways of obtaining your credit score and credit report. A lot of banks offer access to this information. You can also sign up for Credit Karma. This is an app that gives you instant access to this information and is updated regularly. Credit Karma can also help you find options for building or repairing your credit if needed.

STARTING OFF

The first step is focusing on the debt that has the lowest total amount owed. The first step in this process is to get that debt completely paid off. One thing to keep in mind is you will still be making monthly payments as usual on all of your other debts with extra focus on paying the debt with the lowest balance first.

Start by determining if you have any extra money in your budget that can be used toward the debt with the lowest total balanced owed. This doesn’t need to be a large amount and even five to ten dollars can help achieve the final goal. If you can find extra money in your budget then add that amount to you monthly payment. If there is no extra money in your budget don’t worry. This does not mean you won’t be able to pay off your debts, it just might take a little extra time. I also recommend using any extra amounts of money you get (think tax refund, government stimulus, work bonuses, etc) to put toward paying down the lowest balance debt. I know that might not seem fun but look at it as money you’re not going to miss sine its not money included in your monthly budget.

Keep focusing on this debt until it is completely paid off.

THE SNOWBALL EFFECT- THE KEY TO THIS PLAN

What a relief! One debt is completely paid off! This is the time when a lot of people think “now I have extra money every month”! But I am challenging you to change your way of thinking and keep the same monthly budget as you had.

Now you’re probably thinking “what happens to the amount of money I was paying to the debt I just paid off”? Good question! You’re going to add that amount to the minimum payment for the debt that is now the lowest total balance due (you may need to reconstruct your list to determine your new lowest total balance due). For example, say I was paying $30/month toward DebtCard and using all my extra money to pay that card off completely. Now I look at my list and determine that the next account with the lowest amount owed is FutureWise Bank so I add that $30 I was paying to DebtCard toward the monthly payment for FutureWise Bank. This will increase the amount of money you are paying monthly to FutureWise but you are not having to come up with any extra monthly not already included in your budget.

This process will continue every time you pay off a debt until all your debts are paid off. Overpaying on your monthly minimum payment amount will allow you to pay off debts at a faster pace.

CONCLUSION

Paying off your debts can be a long and tedious process that requires a lot of discipline. But if you stick with the plan you will surely see the rewards and enjoy living a debt free life!

Let me know what you think by leaving a comment below and if you like this article subscribe to my blog for more posts dealing with money and be sure to follow me on social media and YouTube!

8 Comments

Brittany Rausch

This is an excellent post with great tips! The snowball effect is so awesome— especially when you pay off the first debt and then keep going! So rewarding! Thanks for sharing

Darla Storm

Thank you! It really is effective as long as you stick to it!

Tiffany

Thank you for pointing out that it is a long process where patience is tested. A lot of us just want a quick fix. Unfortunately, it is discipline, patience, and a plan like you’ve laid out above that really gets the job done over time.

Darla Storm

Thank you! Honestly I wish I had a large amount of money to pay off all debts immediately, but unfortunately that is not the case! Patience and discipline are key (but this is true with most things in life!)!

Simple Steady Home

Thank you for this great reminder that it is a process. So often we can hope to see the change over night but paying off debt is something that takes work for families. Especially with tuition so high these days.

Darla Storm

Ugh tuition and student loans! Yes! It is definitely not an overnight plan and it takes so much planning and then requires the discipline to stick with the plan! In the end it is definitely worth it though!

Ashley Pacheco

Yes!!! Just starting to understand where your money is going can be such an eye opener for some. Great article!

Darla Storm

Thank you! Exactly! Not knowing where your money is going makes it very hard to come up with a plan to get out of debt!